Understanding Currency in Portugal: A Comprehensive Guide

- lisbonbyboat

- Oct 2

- 8 min read

Planning a trip to Portugal? Knowing which cash to carry can make or break your entire experience. Most travelers are surprised to learn that Portugal has used the Euro since 2002 and shares this currency with 19 other countries. But what really catches people off guard is how far local knowledge of currency stretches beyond just bills and coins. That’s where the real travel secrets come alive.

Table of Contents

Quick Summary

What is the Currency in Portugal?

Portugal uses the Euro (€) as its official national currency, a transition that occurred on January 1, 2002, when it replaced the Portuguese escudo. Understanding the currency in Portugal is crucial for travelers and business professionals planning to visit or engage with the country.

Euro: Portugal’s Monetary Standard

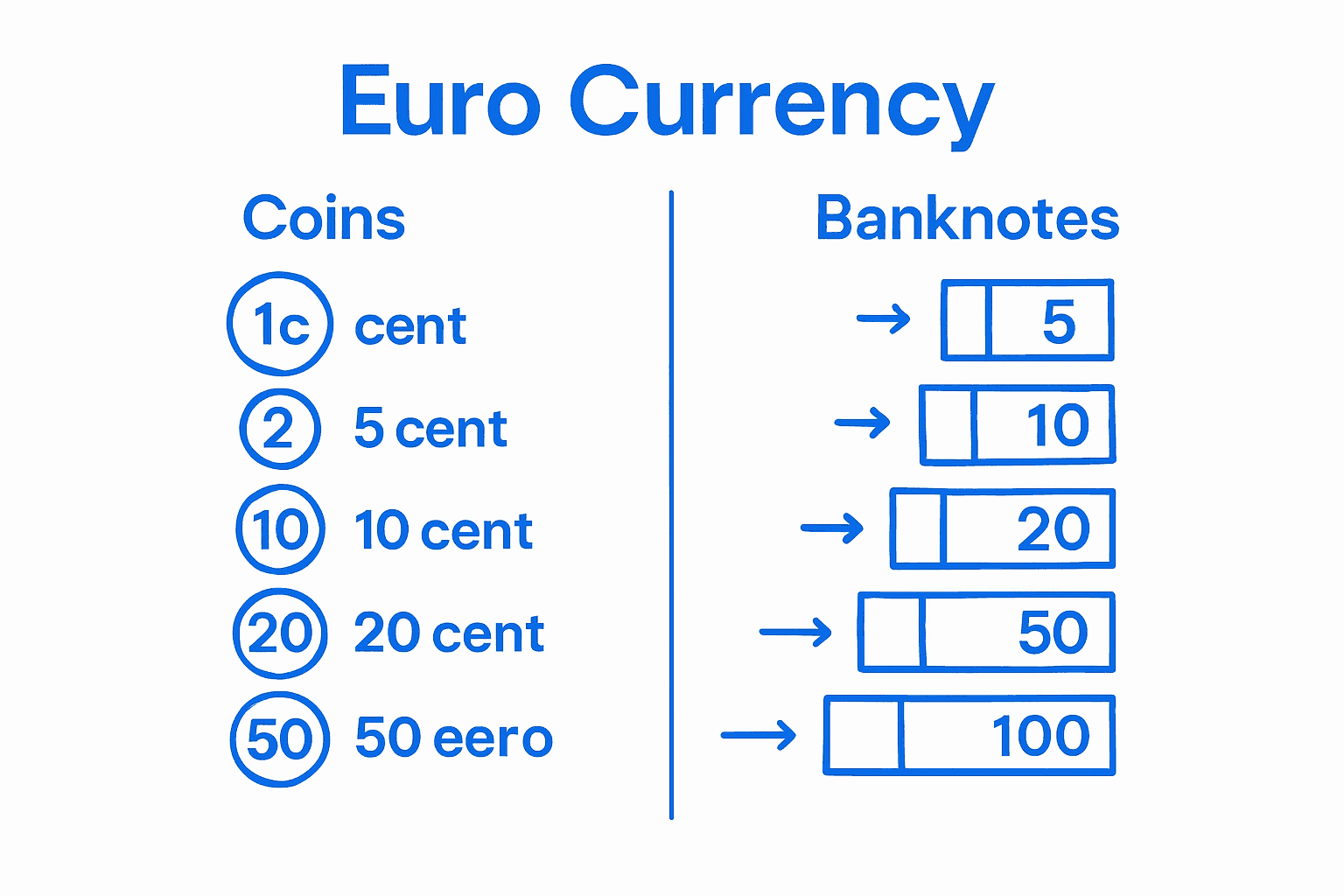

The Euro is a standardized currency used by 20 European Union member states, making financial transactions seamless across these nations. In Portugal, the Euro comes in both coin and banknote denominations. Coins range from 1 cent to 2 euros, while banknotes are available in denominations of 5, 10, 20, 50, 100, 200, and 500 euros.

The European Central Bank oversees the monetary policy and circulation of this currency.

Practical Currency Considerations

When dealing with currency in Portugal, travelers should be aware of several practical aspects:

Cash is King: While credit cards are widely accepted in cities like Lisbon, smaller towns and local establishments often prefer cash transactions.

ATM Availability: Major banks provide easily accessible ATMs in urban areas, making currency withdrawal convenient.

Currency Exchange: Banks and official exchange offices offer reliable currency conversion services with competitive rates.

For travelers looking to understand more about navigating financial aspects of their trip, our guide on understanding travel expenses in Portugal provides additional insights into managing money during your visit.

Why is Knowing Currency Important for Tourists in Lisbon?

Understanding the local currency is fundamental to a smooth and enjoyable travel experience in Lisbon. Knowing how to navigate financial transactions can significantly impact your comfort, safety, and overall trip satisfaction. According to the U.S. Department of State, being financially prepared helps travelers avoid unnecessary complications during their journey.

Financial Navigation and Practical Preparedness

Tourists who understand the local currency can make more informed decisions about spending, budgeting, and managing their financial resources. In Lisbon, where tourism is a significant economic driver, being currency-savvy means avoiding potential pitfalls like unexpected fees, poor exchange rates, or misunderstandings during transactions.

Key aspects of currency knowledge for tourists include:

Transaction Efficiency: Knowing how to use euros smoothly reduces stress and potential embarrassment in restaurants, markets, and public spaces.

Budget Management: Understanding the currency helps travelers track expenses more accurately and prevent overspending.

Safety Precautions: Awareness of currency helps in identifying potential scams and making secure financial choices.

Cultural and Economic Insights

Beyond practical considerations, understanding currency provides deeper insights into Portugal’s economic landscape. The euro represents more than just a medium of exchange it symbolizes Portugal’s integration into the European Union and its economic interconnectedness.

For travelers looking to explore Lisbon more economically, our budget travel guide offers additional strategies for making the most of your euros while enjoying everything this vibrant city has to offer.

How Currency in Portugal Works in Everyday Transactions

Everyday currency transactions in Portugal follow standard European financial practices, with the euro serving as the primary medium of exchange.

To help readers compare payment options for everyday transactions in Portugal, the table below summarizes the main features, acceptance, and practical notes for each method mentioned in the article.

Payment Methods and Transaction Norms

Portuguese businesses typically accept multiple payment methods, with cash and electronic payments being equally prevalent. Credit and debit cards are widely accepted in urban areas like Lisbon, particularly in restaurants, hotels, and larger retail establishments. However, smaller local businesses, traditional markets, and family-owned shops often prefer cash transactions.

Key transaction considerations include:

Cash Preferences: Many small establishments have minimum purchase amounts for card transactions.

Tipping Culture: Service workers typically do not expect large tips, with rounding up or leaving 5-10% being considered generous.

VAT Refund: Tourists can claim VAT refunds on significant purchases, providing additional financial flexibility.

Digital and Traditional Banking Interactions

Modern banking in Portugal integrates traditional and digital platforms seamlessly. ATMs are ubiquitous in cities and towns, offering easy access to cash withdrawals. Most banks provide English-language interfaces, making transactions convenient for international travelers.

Foreign visitors should be aware that some banks might charge international transaction fees. Contactless payments are increasingly common, with many establishments accepting mobile payment platforms like Apple Pay and Google Pay.

For travelers interested in exploring more about managing expenses during their Lisbon adventure, our guide to understanding taxi prices offers additional practical financial insights for navigating the city.

Key Concepts of Currency Exchange and Payment Methods

Navigating currency exchange and payment methods in Portugal requires understanding several fundamental principles that ensure smooth financial transactions for travelers and international visitors. According to the European Central Bank, international monetary interactions demand strategic knowledge and awareness.

Understanding Currency Exchange Dynamics

Currency exchange in Portugal involves multiple channels, each with unique advantages and considerations.

To clarify the different options and their features, this table outlines the main channels for currency exchange in Portugal along with their advantages and potential drawbacks as described in the article.

Key currency exchange considerations include:

Bank Exchange Rates: Often more competitive than airport or hotel exchanges

Transaction Fees: Some banks charge additional percentage fees for international withdrawals

Daily Withdrawal Limits: ATMs typically have maximum daily withdrawal amounts

Payment Method Strategies

Effective payment strategies in Portugal involve diversifying financial tools. Credit cards with no foreign transaction fees, prepaid travel cards, and a small amount of cash provide flexibility. Visa and Mastercard are widely accepted, while American Express might have more limited coverage.

Technological advancements have transformed payment methods, with contactless and mobile payments becoming increasingly prevalent. Many Portuguese establishments now support digital wallet technologies like Apple Pay and Google Pay, offering convenient alternatives to traditional payment methods.

For travelers seeking additional insights into managing expenses during their Portuguese adventure, our budget travel guide provides comprehensive strategies for financial navigation.

Real-World Context: Currency Usage in Corporate Events

Corporate events in Portugal present unique financial dynamics that require strategic currency management and understanding. According to European Business Standards, navigating monetary transactions during professional gatherings demands precision and awareness of local financial practices.

Financial Planning for Corporate Gatherings

When organizing corporate events in Lisbon, financial preparations extend beyond basic budgeting. Companies must consider multiple currency-related factors that impact overall event economics. This includes understanding payment structures, expense tracking, and financial compliance within the European monetary framework.

Key financial considerations for corporate events include:

Invoicing Standards: Most Portuguese businesses require euro-denominated invoices

Payment Platforms: Corporate credit cards and bank transfers are predominantly used

Expense Documentation: Detailed financial records are crucial for international corporate accounting

Technological and Transactional Insights

Modern corporate events leverage sophisticated payment technologies that streamline financial interactions. Digital payment platforms, real-time currency conversion tools, and integrated expense management systems have transformed how businesses handle monetary transactions during professional gatherings.

International corporations typically prefer electronic payment methods that offer transparent exchange rates, minimal transaction fees, and immediate processing. Many Portuguese venues and event management companies now support multiple digital payment infrastructures, enabling seamless financial exchanges.

For organizations planning team building activities or corporate retreats in Lisbon, our guide to understanding taxi prices provides additional insights into managing local transportation expenses during corporate events.

Discover Lisbon’s Beauty With Confidence in Every Euro

Planning your Lisbon adventure can feel overwhelming, especially when you are learning about currency exchange, payment methods, and ways to manage expenses as you explore Portugal. You deserve a travel experience that eases these worries and helps you make the most of every euro spent. Imagine enjoying seamless payment options and understanding how to get real value through every stage of your journey.

See how effortless spending can make your trip unforgettable. Choose Lisbon By Boat for an unforgettable sailing tour along Lisbon’s historic coastline. Every journey features clear guidance, upfront pricing, and support for multiple payment methods. Secure your spot on a regular sailing tour or opt for a private yacht cruise today. Experience Lisbon from the water while feeling confident and prepared. Book now and take the first step toward a trip that is truly stress-free.

Frequently Asked Questions

What currency is used in Portugal?

Portugal uses the Euro (€) as its official currency, which replaced the Portuguese escudo in 2002.

Are credit cards widely accepted in Portugal?

While credit cards are widely accepted in major cities, many smaller towns and local businesses prefer cash transactions, so it’s advisable to carry some euros.

What are the best ways to exchange currency in Portugal?

Currency exchange can be done at banks, authorized exchange offices, or ATMs. It’s recommended to compare rates and consider any transaction fees before exchanging.

How can travelers manage their budget using euros in Portugal?

Understanding the euro helps travelers make informed spending decisions, track expenses accurately, and avoid potential pitfalls like poor exchange rates or unexpected fees.

Recommended